By Lex Schroeder. This piece was originally published in the Changemaker Strategies channel at Medium.com.

Marianne Schnall and Tuti Scott

The agenda for “Women & Money: Making Money Moves that Matter” September 16–17 in Austin went beyond keynotes, panels, and “fireside chats” to prioritize action. For producer Tuti Scott and event partner Marianne Schnall, the goal was to do more than impart knowledge; it was to encourage people to organize across shared values and experiment with new practices in gender lens giving, spending, and investing with a gender, racial, and economic justice lens. The team paid careful attention to how participants would engage and embody their leadership (read Our Commitments), not just what was on the agenda. View the full program here and read Gwendolyn VanSant’s statement on how Women & Money participants were invited to practice equity and inclusion during the event here.

Participants were encouraged to tell their money stories (even when those were vulnerable), lead their own conversations, use their voice and ask courageous questions, and practice accountability. In addition to hearing from field leaders like Joy Anderson (The Criterion Institute), Sara Brand (True Wealth Ventures), Patricia Farrar-Rivas (Veris Wealth Partners), Tracy Gray (The 22 Fund & We Are Enough), Kristin Hull (Nia Impact Capital), Antoinette Klatzky (Eileen Fisher Leadership Institute), Natalia Oberti Noguera (Pipeline Angels), Katherine Pease (Cornerstone Capital), Ellen Remmer (Invest for Better), Rachel Robasciotti (Robasciotti & Phillipson), Susan Witt (Schumacher Center for New Economics), and more (see full list here), participants organized across two rounds of breakout sessions (see topics here) and participatory Open Space conversations on day 2 in response to the question: “What does it take to be more courageous with our money and lead with values of equity and justice?”

Read on for nine key insights (as shared with Changemaker Strategies by breakout session participants):

1. Ranked choice voting advances gender and racial justice and deserves our financial support. (From “Investing in Women and Politics,” Cynthia Richie Terrell)

We have to shift systems and processes in our electoral system that hold people back. Our “winner-take-all” voting system hurts women and people of color who tend to do better in ranked choice systems which also ensures partisan fairness. There is a lack of long-term, bold funding in this space.

Actions:

- Engage shareholder activism around company lobbying activities and PACs and use collective action to influence PACs to invest a higher percentage of dollars in women candidates.

- Engage B-Corps to pay more attention to this work

- Learn more at RepresentWomen

2. It is wise to work with a financial advisor who can help you connect your philanthropy, investing, and advocacy efforts. (From “Aligning your Dollars for Impact,” Leena Barakat & Akasha Absher)

We view philanthropy, investing, and advocacy as separate buckets of work, but when we do this, we may do something in one area that cancels out our impact in another. By coordinating our assets, we can make a much more positive impact.

Actions:

- Look for diverse financial advisors and management firms and be intentional about where and how you invest your assets.

- Do some real due diligence on how ESG is integrated in your portfolio. Be active with your investments and think about the underlying companies’ governance structure and diversity and inclusion practices.

- Find more resources at As you Sow and Social Investment Forum.

3. To change VC, we need more women partners driving institutional change. (From “Venture Capital Investing to Maintain the Innovation Economy,” Kerry Rupp & Sara Brand)

75% of investment dollars into VC funds come from institutional investors, but venture capital is broken. Only 2.19% of VC’s investments go to women (women of color receive less than 1%) and there aren’t enough women investors, even though by 2030, two-thirds of investable assets will be held by women. And there is no shortage of women-led companies. When you have more women general partners at the funds and limited partners investing in the funds, that is the start of a movement to change institutional barriers. To start, this looks like redefining Emerging Manager Programs, redefining attributable track records, more transparency and standardized metrics, creating a “fund of funds” strategy, and “right-sizing” funds.

Actions:

- Read “Sexual Discrimination, The State Of Venture Capital And How To Fix It”

- Read “How to Finally Fix the Gender Gap in VC”

4. One main reason VC is broken is that it is over-focused on growth at any cost. (From “Venture Capital Investing to Maintain the Innovation Economy,” Kerry Rupp & Sara Brand)

This creates distortions and concentrations of wealth (and an overemphasis on “unicorns versus zebras.”) We change this by expanding the circle of investors, and encouraging people, particularly women, to embrace their own unique investing style. Ask, does your enterprise concentrate wealth or distribute wealth?

Tracy Gray, Marianne Schnall, Antoinette Klatzky, Roshell Rosemond Rinkins

5. We are moving from an economic system built on stolen land and labor to one that honors human rights, dignity, and safety. (From “Investing with a Racial Justice Lens,” Rachel Robasciotti)

People think about financial returns all wrong. It’s not just personal; we are social creatures, and we must think about the future we are all collectively invested in. Be careful not to invest in the private prison exploitation of labor and invest instead in human rights and environmental health.

Actions:

- Watch Ava Duvernay’s film, The 13th.

- Get started with RISE’s quick video on social justice investing.

- Review resources at ICCR and Investigate.afsc.org.

6. It’s not just what we invest in that needs to change; our investing models and decision-making processes must change, too. (From “Gourmet Investing with Race and Gender Centered Solidarity,” Maria Jobin-Leeds & Nia K. Evans)

The Ujima Project uses a multi-stakeholder, community-based investing process. This is just one way it goes beyond ESG screenings to look at an investment’s impact on racial justice. Community members take a vote on which businesses are still needed, which are working well, and which need to be replaced. When it comes to voting power, decision-making is linked to the “intimacy of living in a particular place,” not size of investment. Whether people give $25 or $250,000, they get one vote. Community members are connected by new decision-making processes as much as new investments.

7. When women create or join a circle of fellow social impact investors, they are more likely to move their money. (From “Invest for Better,”Kathleen McQuiggan & Ellen Remmer)

Women are more interested in impact investing than men, yet only about half of women who have an interest in it follow through. Why? Barriers include finding the time and confidence to invest to feeling a sense of trust and ease in one’s own strategy. For some, it’s about not having a financial advisor or not being able to convince investment partners about the benefits and competitive returns of impact investing. Financial services organizations are behind in teaching gender lens and social impact investing. But when you pull together groups of people who build a community of trust, set goals together, and hold each other accountable, investing gets easier. At the end of six sessions in a recent Invest for Better circle, 60% of participants moved their money to impact and 80% were asking more questions about their money.

Actions:

- Watch videos, hear stories, and find resources with clear action-steps at Invest for Better

- Pledge to take any one of 12 simple action steps to help you move to action. Find the pledge here or Text 73245.

- Start an Invest for Better group or join one. Use the Toolkit to help you get started.

8. Land is central to social impact philanthropy because land creates a place to work and live for people who have been marginalized historically (e.g people of color, women, indigenous, and LGBTQ people) (From “New Economics Strategies and Perspectives in Justice Work,” Gwendolyn VanSant & Susan Witt)

Since land has been forcibly taken away from First Nation and/or people of color, voluntarily giving it to a trust with the specification that it be used by First Nation and/or people of color is a powerful form of reparation.

Actions:

- Educate yourself about the historical relationship between land, money, and the subjugation of women, indigenous people, and people of color.

- Read The Color of Money: Black Banks and the Racial Weallth Gap by Mehrsa Baradaran and The Color of Wealth: The Story Behind the U.S. Racial Wealth Divide, by Meizhu Lui, Bárbara Robles Betsy Leondar-Wright, Rose Brewer, Rebecca Adamson.

9. Climate change has motivated a “land and resource grab” by interests that are antithetical to social and economic justice. Community land trusts offer a way to get ahead of this investment wave. (From “New Economics Strategies and Perspectives in Justice Work,” Gwendolyn VanSant & Susan Witt)

Actions:

- Give land to Community Land Trusts. See The Schumacher Center for a New Economics for general info.

- Contact Gwendolyn VanSant to specify reparations as use for the trust.

Additional breakout sessions not reflected above included “Journey to Impact Investing” with Nicole Bagley & Stephanie Gripne and “Blockchain 101 and 202” with Shailee Adinolfi.

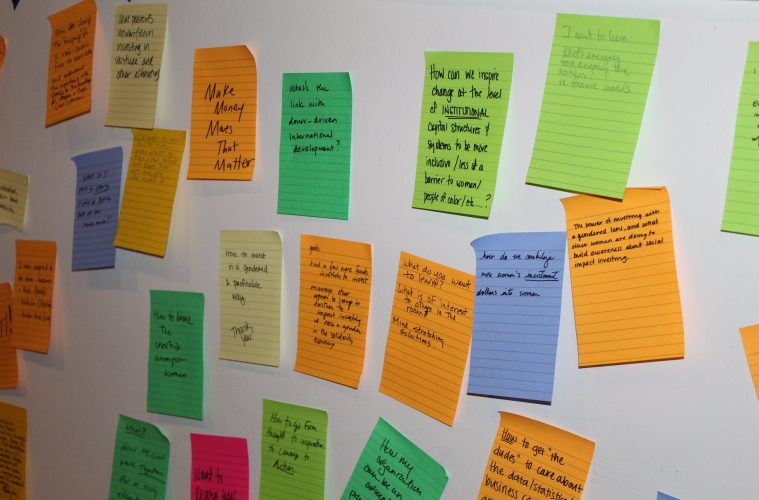

And finally, what did Women & Money participants want to talk about during day 2’s Open Space session in response to, “What does it take to be more courageous with our money and lead with values of equity and justice?”

Twelve participants stepped up to start these conversations below:

- Tension between adding more women and people of color to mainstream models versus creating new, more radical, democratic, redistributive models…

- Platform for sharing best practices to advance women across sectors?

- How do we bring/invite women to be funded to those who have received millions?

- How do we get more brilliant women leaders like some of the people here today into CEO positions?

- How can investors align their actions/advocacy with their investments and serve as an “accomplice” with impacted communities, not just invest in them?

- Corporate financial innovation and impact investing.

- How do we invite more social justice activists into this work?

- Moving money toward gender justice and climate justice. What are the synergies, opportunities, challenges?

- Do you know your number? How much money do you really need?

- How do we reduce/destroy barriers to access (opportunities, capital, networks)?

- How will you inspire your family, clients, companies, etc. to view gifts to minority and/or women-run nonprofits and underrepresented communities as a good, viable, ROI? (ROI = humanity)

- How do White and White presenting people integrate equity when people of color aren’t there to lead?

These conversations are only just getting started!

Join the “Women & Money: Making Money Moves that Matter” LinkedIn group to connect into this free community of leaders and learners. Read articles by Women & Money experts and conversation starters here.

What’s next? For Tuti Scott, she says, “The work of women and their allies stepping into their money and power stories will continue to be transformational. More platforms, conversations, and gatherings will create spaces for people to ‘make money moves that matter’ to their hearts, minds, portfolios… and, ultimately, to create a more just world.”

Need more inspiration? Watch this short video on the event. Scroll through photos of why Women & Money participants decided to come to Austin, who inspired them to be there, what folks told us they want to learn, and where people ended up by way of new individual and collective “money moves.”

________________________________

This piece was written in partnership with Changemaker Strategies & What Will It Take Movements. In synthesizing notes collected on-site, the author aimed as much as possible to include only those learnings and insights reported and shared back to Changemaker Strategies by event participants.

We wish to thank every person at “Women & Money: Making Money Moves that Matter” who contributed and/or volunteered to support the ways we connected in person and are contributing and volunteering still. Thank you for helping to move this community forward!